INTRODUCTION

In March 2020, the world changed. As COVID-19 swept across the globe and people were locked in their homes, we all had no choice but to adapt to our new circumstances. Basic routines like shopping, consuming media and working – simple everyday tasks, changed with the times.

Some technologies needed to be created out of whole cloth (touchless pickup protocols), while others simply found themselves in the right place at the right time. For example, Zoom’s annual minute usage went from 60 billion in 2019 to 3.3 trillion throughout 2020. I had never used Zoom to communicate with my colleagues in the office next door, did you?

Many industries suddenly found themselves having to think like a Silicon Valley start-up just to survive, and this includes the Insurance Industry. Insurance Technology (InsureTech) has simplified many aspects of the policyholder’s experience. A robust 61% of policyholders polled said they prefer to interact with digital interfaces rather than live agents. However, the adoption of InsureTech has been far from uniform, often leading to a few technology leaders and many more insurance traditionalists. A McKinsey 2019 analysis identified aging IT infrastructure as a major block to digitization for most Insurers, with 2019 IT investments of $225B USD unable to properly prepare Insurers for the upcoming 2020 issues. Therefore, with this unequal adoption of technology, many insurers would have been unable to facilitate claims during the COVID lockdowns properly.

Enter the third-party vendors, often more agile with less cumbersome legacy systems, and find themselves able to take the InsureTech lead during the COVID lockdowns. Telehealth, while not a new process, as it was first used in 1959, had many obstacles to overcome, including bandwidth, cybersecurity, data storage, regulatory compliance, and consumer adoption. The technology started gaining traction by focusing on healthcare niches, such as training and rural patient care. However, with COVID, the adoption rate became turbocharged as Insurers and their supporting vendors either found themselves in a Zoom-like position (right place/ right time) or playing catch-up.

Digitization was a natural progression for many aspects of the industry, including the quotation process and reviewing documentation for an existing policy. However, in more obscure niches, it wasn’t so obvious or even clear that digitization would work.

Enter the Independent Medical Examination sector (or IME)

IMEs are an obscure area of the insurance claims process that wouldn’t be well known to the general public but an essential service for claims professionals. IME providers have traditionally facilitated medical examinations requiring the claimant to be present in-person but, like so many other industries, needed to adapt during the COVID lockdowns to ensure claims were adjudicated in a timely manner.

Many of the obstacles that have prevented TeleHealth from mass adoption were quickly being overcome. With access to broadband and a decent camera somewhat ubiquitous, video conferencing was no longer in the realm of the Jetsons anymore. SIMAC, pre-COVID, had seen the power of this new technology and thought it could be applied, via a virtual assessment (or V.A.), a first for the Canadian insurance industry, finding itself at the right place, right time once people were forced to stay home.

But the big question would be, “After the world returns to normal, have virtual assessments had their time in the sun or will they become a part of the claims process standard operating playbook?”

1. https://backlinko.com/zoom-users

2. https://www.altexsoft.com/blog/insurance-technologies/

VIRTUAL ASSESSMENTS → THE RUNDOWN

The goal for all stakeholders in the claims process is to have the file move through the adjudication system as quickly as possible. Often physical examination data yields little extra insight above the “onset data” provided by the diagnosis. This is when a virtual assessment can make a lot of sense. The benefits of a V.A. may seem obvious, but the widespread adoption won’t be fully realized until the near term and major roadblocks are addressed.

| IMMEDIATE BENEFITS | NEAR TERM ISSUES | MAJOR ROADBLOCKS |

|---|---|---|

| Reduced anxiety and COVID exposure | Assessor jurisdictional approval | Onset data is unreliable or unavailable |

| Less travel and wait times | Claimant technology access (ex: hi-def camera) | Threats of legal, via “insufficient data” challenge (although approved by courts) |

| Greater assessor availability | Assessor technology adoption (ex: secured communication</td | Inconsistent jurisdictional laws |

| Environmental impact | Onset data organization | |

| Standard examination policy | Consent and I.D. verification | |

| More time with an assessor |

Near term issues are often just process flaws that can be ironed out with careful planning and communication. Let’s review…

| NEAR TERM ISSUES | PROCESS GAP | SIMAC RESOLUTION |

|---|---|---|

| Assessor jurisdictional approval | Assessors not licensed countrywide leading to regional bottleneck | Recruit assessors licensed in multiple jurisdictions to avoid bottlenecks |

| Claimant technology access (ex: hi-def camera) | Claimant lacks access to the required technology to conduct a viable IME, such as (unreliable WiFi in remote areas) | Pre-screen technological equipment or capabilities prior to coordinating assessments

Arrange to bring technology and assistance closer to claimants’ location, including training |

| Assessor technology adoption (ex: secured communication) | Assessor lacks ability to secure medical documents properly | All communications are in pdf format and password protected |

| Onset data organization | Initial medical documentation is unorganized, making it time-consuming for an assessor to begin pre-assessment | Pre-assessment process in place to remove unnecessary and duplicate documents and indexed for quick and convenient access |

| Consent and I.D. verification | Risk of identification fraud | Provide pre-signed consent prior to assessment and display government-issued photo I.D. to the camera prior to assessment |

The onboarding documents are key in ensuring any IME is efficient, safe, secure and unbiased.

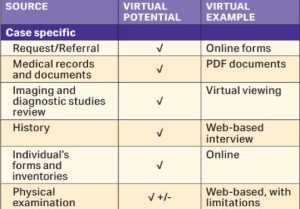

Onboarding Documents Table

According to the AMA, any onboarding data required for a proper pre-assessment screen has already been migrated into a virtual format. Having the entire claimant process managed virtually will allow a seamless flow and review of claimant data. SIMAC has adopted a robust internal policy along with 3rd party software to make the entire onboarding package standardized and easy to read. We feel this process can still be quite manual, especially

According to the AMA, any onboarding data required for a proper pre-assessment screen has already been migrated into a virtual format. Having the entire claimant process managed virtually will allow a seamless flow and review of claimant data. SIMAC has adopted a robust internal policy along with 3rd party software to make the entire onboarding package standardized and easy to read. We feel this process can still be quite manual, especially

moving data from one system to another, but developments in A.I. will overcome any obstacles, and we agree with the AMA that no part of the IME process cannot be improved by technology.

Moving on from near-term issues, major roadblocks are obstacles driven by industry protocols or gaps in information that would render an IME report low-quality or biased. The common saying is that “time heals all wounds,” well, we feel time will help sort out many of these major roadblocks. The American Medical Association (AMA) has already laid out comprehensive guidance on virtual assessments as a telemedicine procedure, recognizing the process as a cost-effective tool to connect with claimants. Therefore, the medical professional bodies have jumped in with both feet, providing the industry assurance that V.A. is an important tool. It will take time for the Canadian bodies and case law to shake out any issues specific to our country. SIMAC will continue to monitor and post any legal decisions and other rulings or communications that would create greater clarity.

3. www.ama-assn.org/system/files/2020-06/virtual-medical-impairment-assessments.pdf

4. https://www.ama-assn.org/system/files/2020-06/virtual-medical-impairment-assessments.pdf

VIRTUAL ASSESSMENTS → THE FUTURE

Despite the major roadblocks for V.A.’s deriving from internal or external processes, there is still a technology gap, especially when a physical assessment yields a lot of insight or onboarding data is unreliable. Several startups have arisen to fill these needs that work with existing video conferencing platforms, utilizing the latest tech like A.I., large language models or even VR. Let’s review some technologies that have entered the market and their impact on both the communication process (felt by the claimant) and the IME process (felt by the assessor)…

| TECH COMPANY | PROCESS | IMPROVEMENT TO VIRTUAL COMMUNICATION? | IMPROVEMENT TO IME PROCESS? |

|---|---|---|---|

| Kudo Way | Improve access to language interpreter | X | X |

| Wise Docs | Eliminate wait times with medical doc organization | X | |

| Wellue’s DuoEK | Wearable ECG monitor | X | X |

| Auth0 | 2 factor authentication to improve record security | X | |

| OnePlus | Facial, muscle biometric recognition | X |

This is just a short list of companies that are using A.I., large language models (think ChatGPT) and other technologies relying on improved camera technology. Biometrics is expected to be a $70B market by 2025, with COVID and the virtual assessment market being the catalyst for innovation. However, many of these innovations still need to deal with one hurdle; actually have a virtual claimant be in physical ownership of the device. Luckily, companies like 23andme and other at-home test kit companies have already proven out and solved for shipping back/forth sometimes costly equipment. If (re)packaging and shipping, along with offering disincentives for failing to return the products, is made clear enough, stakeholders will be willing to go along with the program.

There are still pockets of innovation that need to occur in order for the process to be enhanced, in most use cases, beyond the in-person assessment. In our opinion, after conducting thousands of IMEs, here are some key areas that can be improved by utilizing some of the latest technology but have yet to move beyond a beta phase…

5. https://imageware.io/4-applications-of-biometrics-in-telehealth-services/

| PROCESS | TECHNOLOGY | IMPROVEMENT |

|---|---|---|

| Language interpretation | A.I. | Back-and-forth dialogue, optimized for health terminology |

| History Pre-screen | LLM Chatbot | Instead of assessor, conduct pre-screen interview with claimant using chatbot |

| Range of Motion Assessment | Smartphone app synced with hardware | Use smartphone integrated magnetometer instead of traditional goniometer |

“Hot” technologies are definitely a risk, like ChatGPT, that can’t be used due to a conflict on who would own the assessment data or A.I. who could make a miscalculation during the V.A. leading to a wrongful report conclusion. More time and greater sample size will reduce any error bars, but human oversight will need to be involved until the error output bar is next to zero.

CONCLUSION

We titled the article “Virtual IMEs – A Better Experience vs. In-Person Assessments?” It is our conclusion that not only did V.A.’s fill a distinct gap during the COVID lockdowns to keep claims flowing promptly through the system but has actually created a better experience for all stakeholders, from the claimants, lawyers and assessors to the insurance industry. Despite the stigma still attached to V.A., with downsides still apparent, the adoption of this technology has yielded a better product. The V.A. process will only improve with the increase in sample size and tail risk cases moving through the technology and judicial process.

Stay tuned for more to come from SIMAC Canada as we continue to be on the cutting edge of the adoption of these technologies.