Near my home in a west Toronto neighbourhood, was a very popular French restaurant with reservations that were hard to come by. On a typical summer Saturday evening, all the tables were filled with happy couples and families enjoying a night out. However, one day, a notification was posted on the door that the restaurant had closed due to difficulty finding staff.

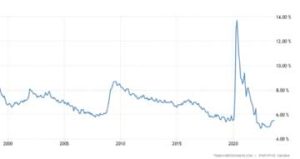

Canada Unemployment Rate

Canada Unemployment RateNot localized to the notoriously difficult restaurant business, companies across Canada find it difficult to attract and maintain employees. New terms like “the Great Resignation” were coined to capture this recent trend. Whether it’s burnout, stress, changing lifestyle priorities or turning to new careers, the Canadian labour market remains historically tight, with unemployment rates in the 4.5% – 5.5% range. Compare this to the typical Canadian unemployment rate, in the 8-12% range seen since the 1970’s1. Job vacancies in typical full-employment industries, like healthcare, are rising at 20% or more2. This gap in recent unemployment rates versus 40-year historical trends is like other G8 economies, but Canada’s “Great Resignation” is even more pronounced, which should make every Canadian employer sit up and pay attention.

Understanding the broader trends in the labour market should pressure HR departments to look at each internal policy relating to the treatment of existing staff to ensure those who don’t join the “Great Resignation” are happy and productive. Anytime a team member falls victim to injury, whether at home or work, their absence makes the impact much more serious, given how tight the labour market is for the foreseeable future. Don’t be like my local French restaurant!!

At any given time, 8-12% of Canadians in the workforce are off work due to injury, whether it be STD/ LTD or receiving worker’s compensation3. The longer they stay on disability, the less likely companies will see them return to work. In fact, after a year of absence, only 20% do come back. Studies have shown that employers pay nearly 10% of the total payroll on absence costs relating to administration and lost productivity. Retraining a successor (if you can find one) will cost the employer 120% of the annual salary of a non-professional worker. Stats Canada cites the average profit margin for Canadian industry at 8-9%, so unusually high costs to address employee absence can mean the difference between a net profit and net loss.

The impact of being on disability is a two-way street. Besides the lost productivity felt by the employer, the employee could experience huge costs in lost wages, plus the mental strain of not being a valued member of society. With typical LTD plans to pay out 40-70% of income and CPI inflation as high as 8.5% in 2022, this will have a major impact on employees and their families.

Whether they have decided to self-insure or not, HR departments across Canada must have a robust policy to address cost and lost productivity management. A good process, independent of how the plan is administered, addresses how and when that employee should be medically evaluated. The process must be unbiased and provide the employee with dignity that doesn’t just see them as lost productivity hours. If an injured employee sees the company trying to interpret results in their favour, the odds of them returning will even lower.

According to a study by the Canadian Institute of Actuaries (CIA) published in 2019 and running over a 3-year period, the average employee was on some form of disability for an average of 3.5 years, with 36% of those employees still in active claim status when the study ended. Additionally, the average age of claimants is in their mid-40s, peak performance years, and 20 years out from retirement. These are huge liabilities to whoever assumes the risk of the LTD plan (self or insurance-funded). CIA goes on to state that 95% of those active claims will run out until the termination event of retirement. Companies should expect an active claim to cost more than $750,000 per injured employee, assuming a $50K/ salary, 45 years old and 120% employee replacement costs. The diagram shows % of Canadians (15 years or older) who suffer from various disability types4.

According to a study by the Canadian Institute of Actuaries (CIA) published in 2019 and running over a 3-year period, the average employee was on some form of disability for an average of 3.5 years, with 36% of those employees still in active claim status when the study ended. Additionally, the average age of claimants is in their mid-40s, peak performance years, and 20 years out from retirement. These are huge liabilities to whoever assumes the risk of the LTD plan (self or insurance-funded). CIA goes on to state that 95% of those active claims will run out until the termination event of retirement. Companies should expect an active claim to cost more than $750,000 per injured employee, assuming a $50K/ salary, 45 years old and 120% employee replacement costs. The diagram shows % of Canadians (15 years or older) who suffer from various disability types4.

Implementing an independent medical examination process into an HR standard operating procedure can help to mitigate these risks. IME’s provide an unbiased opinion on the ability of the employee to return to their job or any job and to make recommendations to implement treatment and a return to work (RTW) or accommodation plan. The process remains humane to all stakeholders based on the rule that insurance/ HR departments must disclose the IME report to the employee or treating physician for treatment implementation. The IME process provides an extra layer of transparency to all involved about what a regular doctor is only obligated to disclose permanent work restrictions. With everyone aware of the facts, the employer could find the ones within the organization more suitable, given the injured employee’s status.

What are the IME basics, and when should I use one?…

An Independent Medical Examination company (“IME”) renders a service, not an opinion. There is a key distinction here that should not be overlooked. Typically asked by a court, lawyer, insurance company or self-insured employer, the IME company organizes the service that will provide an unbiased report on the claimant’s condition when benefits, compensation or further treatment are considered. The IME is procured when there is a conflict between the claimant and benefits provider, with the IME scheduling an assessment with an assessor, who will make an independent judgment on the claim. The conflict usually arises when the (self) insurer is looking to deny benefit claims, when they feel the extent of the injuries is being exaggerated. The assessor(s) is not the treating doctor but a licenced doctor, registered nurse or occupational therapist, whom the IME deems to be an unbiased stakeholder. IME duties include the assessor scheduling the assessment, organizing all the necessary medical documents (for the assessor) and distributing the final report in a legible format after a final quality assurance review.

If your decision is to self-insure, you will enjoy plan creativity; however, it can create large volatility in both the STD and LTD payouts. The self-insurer could require the help of an actuary to assess the overall liability exposure or risk of being underfunded. Insurance companies use IMEs for almost half of all claimants and thus have used the service as a risk management tool for many years5. A well-thought-out plan should have a seamless transition from STD to LTD while providing adequate employee protection. We recommend the optimal time to engage with an IME company is when the employee is absent for 5 straight business days. The likelihood they will move to LTD increases; therefore, after the 5-day mark, it will give the process enough time to make an unbiased determination on back-to-work readiness.

What you should be looking for when using an IME provider…

A quick Google search will yield dozens of different IME providers across Canada, some large organizations, and many smaller shops. However, size doesn’t necessarily equate to quality, with the quality of an IME being defined by 2 criteria…

- Are reports produced in a timely manner? Ex: # of days from when an IME is initially ordered to when the final report is distributed.

- Are reports… free of bias? Run by an appropriate assessor? well-organized, thorough, and without much medical jargon and unnecessary information?

To earn the status of being a high-quality IME, they must have access to…

- an assessor roster with geographical breadth, licenced in all Canadian jurisdictions

- an assessor roster capable across all disciplines; often, the cause for disability is based on injuries to multiple body parts, both physical and mental. An IME will need to have a solution for over 30 different medical specialties practiced

- technologies and training protocols to execute virtual assessments, especially if the claimant is remote or unable to travel

- a reputation of unbiasedness; for example, an Ontario Licenced Appeal Tribunal ruled against an insurer based on the biasedness of the IME report. The IME provider failed to recognize their assessor’s “copy and paste” strategy for multiple different claims, where prior assessment reports were basically the same as the assessment in question

- can you reach an intake specialist with relative ease?

- industry accreditations like CARF to help align an SOP to industry benchmarks

- A robust policy on data privacy protection, which is especially important as IME companies will have privy to thousands of medical data points for every case it processes are you aligned ethically with how an IME conducts its business? Is the IME committed to upholding the standards and ethics of the industry? Do they have a DEI policy that aligns with yours?

If the IME has access to the above characteristics, results should be reflected in their KPI scores. The benefit of any new administrator unfamiliar with IMEs is that the industry tracks report timeliness very well. Do not hesitate to ask for a KPI scorecard from your IME provider in order to compare how timely reports are produced. Again, this will indicate the IME’s assessor reach, geographically and by discipline, along with its capabilities to enact a high-touch case (multi-assessment, inability to travel, need for technical training).

Your ability to gauge an IME’s ability to produce bias-free, robust data protection measures will be more nuanced. We suggest a few ways to help determine if the IME provider has been truly independent and not bias…

- LAT decisions

- Assessor geography, discipline schedule (are they spreading the workaround, not favouring just a few doctors, who churn through a lot of claims – poor quality)

- Internal QA policies -> how many reports are sent back?

- Access to preferred dates from assessors (doctors want to work for them)

To reiterate, using an IME who has a reputation for unbiased reports will protect your reputation in the long run. While the IME report may not provide the insured or company an answer it’s looking for on a particular case, being unbiased will prevent negative news being published should a particular case ever get to court.

If you have more questions on evaluating an IME, want to build the IME process into your internal SOP or have any other questions, please get in touch with Michael Yarmo for a demo session. We highly recommend incorporating an IME process into your internal operating plans to manage the risk of lost productivity hours and treat your employees with honour and dignity.

To continue to stay in touch with SIMAC with the following…

Sign up for our monthly insights article

To reach the author, Mike Yarmo

2: https://www.cbc.ca/news/canada/british-columbia/great-resignation-canadian-workers-1.6535538

3: https://www.cspdm.ca/dm-in-context/impact-of-disability/

4: https://www150.statcan.gc.ca/n1/pub/89-654-x/89-654-x2018002-eng.htm

5: https://torontosun.com/2014/08/30/auto-insurance-bomnanza